We’ve built a platform

for crypto investment.

We’re reinventing the global equity blockchian – that is secure, smart and easy-to-use platform, and completely disrupting the way businesses raise capital and the way investors buy and sell shares and also make profit form their investment through this platform.

What is TradeEaseCapitals?

Tradeeasecapitals is a platform for the future of funding and investment for the new equity blockchain.

While existing solutions offer to solve just one problem at a time, our team is up to build a secure, useful, & easy-to-use product based on private blockchain. It will include easy cryptocurrency payments integration, and even a digital arbitration system.

At the end, Our aims to integrate all companies, employees, and business assets into a unified blockchain ecosystem, which will make business truly efficient, transparent, and reliable.

Tradeeasecapitals also excels as a crypto investment company due to its expertise in navigating the volatile cryptocurrency market. With a team of seasoned analysts and traders, they identify promising opportunities and implement strategic investment approaches to maximize returns while managing risk effectively.

The TradeEaseCapitals App APPS

Once you’ve entered into our ecosystem, you can mange every thing. Anyone with a smartphone and an internet connection can partici pate in global marketplace. And also the Tradeeasecapitals application is still under development, will announce the release date soon.

Tradeeasecapitals is poised to revolutionize the crypto investment landscape with its cutting-edge investment app currently under development. This innovative platform is designed to provide users with intuitive tools and real-time insights, empowering them to make informed investment decisions in the dynamic world of cryptocurrencies. The Tradeeasecapitals app boasts a user-friendly interface, making it accessible to both novice and experienced investors alike. With features such as portfolio tracking, market analysis, and customizable alerts, users can stay ahead of market trends and seize profitable opportunities with confidence.

- Crypto-news curation

- Natural Language Understanding

- Wallet aggregation

- Professional Network

- No more expensive fees

TradeEaseCapitals Sale TOKEN

TradeEaseCapitals token is available and on going at the basis of Ethereum, Litecoin, Usdt and Bitocin platform. It’s compatibility of the token with third-party services wallets, exchanges etc, and provides easy-to-use integration.

Start

Feb 8, 2023 (9:00AM GMT)

Number of tokens for sale

900,000 ICC (9%)

End

Feb 20, 2025 (11:00AM GMT)

Tokens exchange rate

1 ETH = 650 ICC, 1 BTC = 1940 ICC

Acceptable currencies

ETH, BTC, LTC,USDT

Minimal transaction amount

1 ETH/ 1 BTC/ 1 LTC/

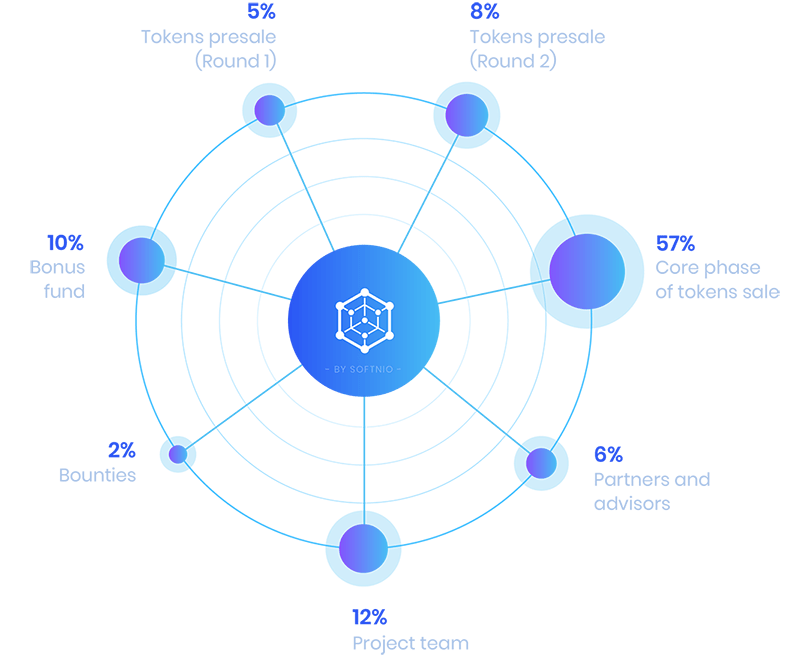

Distribution

of tokens

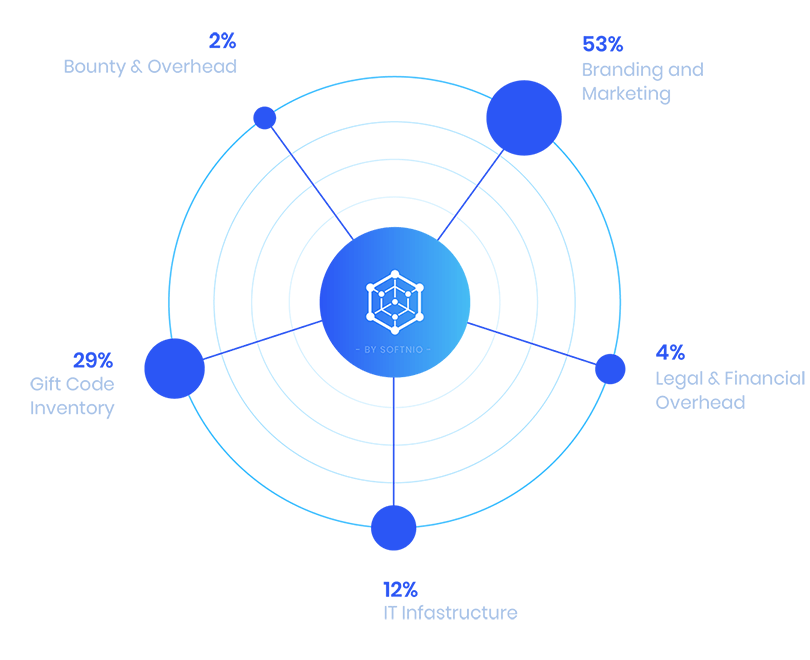

Use

of proceeds

ROADMAP

March 2016

Start of the TradeEaseCapitals Crypto Platform Development.

June 2017

Over 100 merchants on site Already making Profit.

June 2018

Announce the launching of the TradeEaseCapitals mobile App.

August 2019

TradeEaseCapitals preparation & Press Tour

October 2020

Start Token Sale Round (1) And over 2000 clients making profit with ease.

December 2021

Partnership for the future TradeEaseCapitals EcoSystem

January 2022

Our team set-up and commercial preparation

May 2022

Priority opening for Token holders and announcement of TradeEaseCapitals client massive bonus.

June 2023

Start Token Sale Round (2) our clients became overwhelm of our platform and invited so many investors to this platform, it was a game changer

Octorber 2023

Blockchain usage announcement for global Network to the TradeEaseCapitals platform

January 2024

Operational Launch TradeEaseCapitals to the United States to general and so as many other countries

Powered by a Team TEAM

The TradeEaseCapitals Crypto Team combines a passion for esports, industry experise & proven record in finance, development, marketing & licensing.

Waylon Dalton

CEO & Lead Blockchain

Stefan Harary

CTO & Senior Developer

Moises Teare

Blockchain App Developer

Gabriel Bernal

Community ManagementAdvisors

Dylan Finch

Board Advisor

Julian Paten

Board Advisor

Jaxon Kilburn

Board AdvisorPARTNERS

TRADEEASECAPITALS PARTNERS

As seen in

Crypto News NEWS

Pros & Cons of Premined Cryptocurrencies

Premined cryptocurrencies, where a certain amount of coins are created and allocated to a specific...

The Intersection Where Blockchain Meets Energy

The intersection of blockchain and energy represents a promising area of innovation with significant potential...

How & Where To Market Your Tradeeasecapitals Startup

Marketing a startup like Tradeeasecapitals requires a strategic approach to reach your target audience effectively....

Frequently asked questions FAQS

Below we’ve provided a bit of TradeEaseCapitals Token, cryptocurrencies, and few others. If you have any other questions, please get in touch using the contact form below.

Tradeeasecapitals excels as a crypto investment company due to its expertise in navigating the volatile cryptocurrency market. With a team of seasoned analysts and traders, they identify promising opportunities and implement strategic investment approaches to maximize returns while managing risk effectively.

TradeEasecapitals may support a range of popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Ripple (XRP), and possibly others like Bitcoin Cash (BCH), Binance Coin (BNB), or stablecoins like Tether (USDT) and USD Coin (USDC).

To participate in the Tradeeasecapitals platform, you typically need to follow these steps: 1. Visit the Tradeeasecapitals.com website: Start by visiting the official website of Tradeeasecapitals. 2. Create an account: Sign up for an account on the platform by providing necessary information such as your name, email address, and contact details. 3. Complete verification: Depending on regulatory requirements, you may need to undergo a verification process by providing identification documents to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. 4. Deposit funds: Once your account is verified, you can deposit funds into your account using various payment methods accepted by Tradeeasecapitals. 5. Explore investment options: Browse through the available investment options on the platform, including traditional assets, cryptocurrencies, or other financial products. 6. Make investment decisions: Based on your investment goals and risk tolerance, select the assets or products you want to invest in. You may also consider consulting with Tradeeasecapitals experts for personalized investment advice. 7. Monitor and manage your investments: Keep track of your investments through the platform's dashboard and make adjustments as needed based on market conditions or changes in your financial situation. Remember to always conduct thorough research and consider your own financial circumstances before investing in any platform or asset.

You can benefit from the TradeEaseCapitals platform in several ways: Diversification: TradeEaseCapitals offers access to a wide range of investment opportunities, including traditional assets like stocks and bonds, as well as alternative investments like cryptocurrencies and commodities. Diversifying your investment portfolio across different asset classes can help mitigate risk and improve your overall returns. Expertise: TradeEaseCapitals employs experienced investment professionals who analyze market trends and identify promising opportunities. By leveraging their expertise and research capabilities, you can make more informed investment decisions and potentially achieve better results. Convenience: The TradeEaseCapitals platform provides a convenient way to manage your investments online. You can access your portfolio, track performance, and make transactions from anywhere with an internet connection, saving you time and effort. Education: TradeEaseCapitals offers educational resources and tools to help you improve your investment knowledge and skills. Whether you're a beginner or an experienced investor, you can access articles, videos, webinars, and other educational materials to enhance your understanding of financial markets and investment strategies.

The minimum investment requirement to participate in Tradeeasecapitals may vary depending on the specific investment products or services offered by the platform. Typically, investment platforms like Tradeeasecapitals cater to a wide range of investors, from retail investors to institutional clients, and may have different minimum investment thresholds for each type of investment opportunity. For example, Tradeeasecapitals may have a lower minimum investment requirement for certain investment products such as mutual funds, exchange-traded funds (ETFs), or cryptocurrency portfolios, which are accessible to individual retail investors with smaller amounts of capital to invest. On the other hand, Tradeeasecapitals may have higher minimum investment requirements for more sophisticated or exclusive investment opportunities such as hedge funds, private equity funds, venture capital investments, or structured products, which are typically targeted towards institutional investors or high-net-worth individuals. To find out the specific minimum investment requirement for participating in Tradeeasecapitals' investment platform, potential investors should refer to the platform's official website, prospectus documents, or contact Tradeeasecapitals directly for detailed information about the investment products and services available, including any associated minimum investment thresholds.

Tradeeasecapitals employs various risk management strategies to protect investors' capital and optimize portfolio performance. Some common methods include: 1. **Diversification**: Tradeeasecapitals diversifies its investment portfolio across different asset classes, industries, regions, and investment strategies to reduce concentration risk. Diversification helps mitigate the impact of adverse events affecting any single investment or sector. 2. **Asset Allocation**: Tradeeasecapitals strategically allocates assets within its portfolio based on factors such as risk tolerance, investment objectives, market conditions, and economic outlook. By balancing exposure to different asset classes (e.g., equities, fixed income, alternative investments), Tradeeasecapitals aims to achieve optimal risk-adjusted returns. 3. **Risk Assessment and Due Diligence**: Tradeeasecapitals conducts rigorous risk assessment and due diligence processes to evaluate potential investments thoroughly. This includes analyzing financial statements, market trends, competitive positioning, regulatory factors, and other relevant metrics to assess the risk-return profile of each investment opportunity. 4. **Active Monitoring and Surveillance**: Tradeeasecapitals continuously monitors and surveils the performance and risk characteristics of its investment portfolio in real-time. This proactive approach allows Tradeeasecapitals to identify emerging risks, market disruptions, or changes in investment fundamentals promptly and take appropriate actions to mitigate potential losses. 5. **Stress Testing and Scenario Analysis**: Tradeeasecapitals conducts stress tests and scenario analyses to assess the resilience of its investment portfolio under various adverse market conditions, such as economic downturns, geopolitical events, or extreme volatility. This helps Tradeeasecapitals identify vulnerabilities and implement risk mitigation strategies proactively. 6. **Risk Hedging and Insurance**: Tradeeasecapitals may use risk hedging techniques such as options, futures, derivatives, or insurance contracts to protect against downside risks or volatility in specific segments of the portfolio. Hedging strategies aim to limit potential losses while preserving upside potential. 7. **Liquidity Management**: Tradeeasecapitals maintains sufficient liquidity within its investment portfolio to meet potential redemption requests from investors or take advantage of opportunistic investment opportunities. Adequate liquidity management helps mitigate liquidity risk and ensures the smooth functioning of the investment portfolio. Overall, Tradeeasecapitals employs a comprehensive risk management framework encompassing diversification, asset allocation, due diligence, active monitoring, stress testing, risk hedging, and liquidity management to prudently manage risk and protect investors' capital while pursuing attractive investment opportunities.

Yes, Tradeeasecapitals may offer investors the ability to customize their investment preferences or portfolios based on their individual goals, risk tolerance, and preferences. Here's how investors might be able to customize their investments on the Tradeeasecapitals platform: 1. **Investment Objectives**: Investors can specify their investment objectives, whether they seek capital growth, income generation, or a combination of both. Tradeeasecapitals may offer various investment strategies or portfolios tailored to different objectives, such as growth-oriented, income-focused, or balanced portfolios. 2. **Risk Tolerance**: Investors can indicate their risk tolerance level, ranging from conservative to aggressive. Based on this information, Tradeeasecapitals may recommend suitable investment options or allocate assets within the portfolio to match the investor's risk profile. 3. **Asset Allocation Preferences**: Investors can express their preferences regarding asset allocation across different asset classes, such as stocks, bonds, real estate, commodities, or alternative investments. Tradeeasecapitals may provide customizable portfolio models or allocation strategies to align with the investor's asset allocation preferences. 4. **Sector or Industry Preferences**: Investors may have specific preferences for investing in certain sectors or industries based on their knowledge, interests, or beliefs. Tradeeasecapitals may offer sector-specific investment options or allow investors to overweight or underweight sectors within their portfolios. 5. **Ethical or Sustainable Investing**: Investors interested in ethical, socially responsible, or sustainable investing may choose to incorporate environmental, social, and governance (ESG) criteria into their investment portfolios. Tradeeasecapitals may offer ESG-focused investment options or screening tools to align with these preferences. 6. **Customized Portfolios**: Tradeeasecapitals may provide tools or platforms that allow investors to build custom portfolios from a selection of individual securities, funds, or investment products. Investors can select specific assets, weightings, and allocation strategies to create a personalized investment portfolio tailored to their preferences. 7. **Flexibility and Control**: Investors may have the flexibility to adjust their investment preferences or portfolio allocations over time in response to changing market conditions, financial goals, or life events. Tradeeasecapitals may offer ongoing portfolio management services or investment advisory support to help investors make informed decisions and optimize their portfolios. Overall, Tradeeasecapitals may offer investors a range of customization options and flexibility to tailor their investment preferences or portfolios according to their unique financial needs, objectives, and risk preferences. This customization capability allows investors to build diversified, personalized investment portfolios aligned with their long-term financial goals and values.

The fees or charges associated with investing through Tradeeasecapitals may vary depending on the specific investment products or services offered by the platform. Here are some common fees or charges that investors may encounter: 1. **Management Fees**: Tradeeasecapitals may charge management fees for overseeing and managing investment portfolios on behalf of investors. These fees are typically calculated as a percentage of assets under management (AUM) and may vary depending on the investment strategy, portfolio size, and level of service provided. 2. **Performance Fees**: In addition to management fees, Tradeeasecapitals may impose performance fees based on the investment performance relative to a benchmark or predefined performance hurdle. Performance fees are typically calculated as a percentage of the investment gains generated above the specified threshold and are intended to align the interests of the investor and the investment manager. 3. **Transaction Costs**: Tradeeasecapitals may pass on transaction costs associated with buying or selling securities within investment portfolios, such as brokerage commissions, exchange fees, bid-ask spreads, and other trading expenses. These transaction costs can vary depending on the frequency and volume of trading activity within the portfolio. 4. **Administrative Fees**: Tradeeasecapitals may charge administrative fees to cover operational expenses related to account maintenance, reporting, record-keeping, and investor communications. These fees are typically charged periodically, such as annually or quarterly, and may be fixed or based on a percentage of assets under management. 5. **Custodian Fees**: If Tradeeasecapitals uses a third-party custodian to hold and safeguard client assets, investors may incur custodian fees or charges for custody services. These fees are typically passed on to investors and may vary depending on the custodian's fee schedule and the size of the investment portfolio. 6. **Advisor Fees**: If investors work with a financial advisor or investment advisor affiliated with Tradeeasecapitals, they may incur advisor fees for advisory services, financial planning, portfolio management, or investment advice. These fees are typically negotiated between the investor and the advisor and may be based on a flat fee, hourly rate, or percentage of assets under management. 7. **Other Fees**: Depending on the investment products or services offered by Tradeeasecapitals, investors may encounter other fees or charges, such as account setup fees, withdrawal fees, transfer fees, redemption fees, or fees for additional services or features. It's essential for investors to carefully review the fee schedule and disclosures provided by Tradeeasecapitals and understand the total cost of investing, including all applicable fees and charges, before making investment decisions. Transparent disclosure of fees and charges helps investors evaluate the overall value proposition of investing through Tradeeasecapitals and assess the impact of fees on investment returns over time.

As an AI language model, I can't provide real-time information about specific companies' regulatory status. However, it's crucial for investors to verify the regulatory status of any investment platform like Tradeeasecapitals before investing. Financial regulations vary by country, and investment firms are typically required to be licensed or registered with relevant regulatory authorities to operate legally. Here are some steps investors can take to verify the regulatory status of Tradeeasecapitals or any investment platform: 1. **Check Regulatory Websites**: Visit the website of the regulatory authority in the jurisdiction where Tradeeasecapitals operates. Look for a list of licensed or registered investment firms, and search for Tradeeasecapitals or its parent company to see if it's listed. 2. **Contact Regulatory Authorities**: Reach out to the regulatory authority directly via phone or email to inquire about the regulatory status of Tradeeasecapitals. Provide any relevant information you have about the company, such as its name, address, or registration number. 3. **Review Disclosures**: Look for disclosures or legal documents on the Tradeeasecapitals website or in account opening materials that provide information about its regulatory status, licenses, registrations, or memberships in professional organizations. 4. **Check Financial Services Register**: In some countries, regulatory authorities maintain an online register or database of licensed financial services providers. Search the register using Tradeeasecapitals' name or registration details to verify its regulatory status. 5. **Consult Legal or Financial Advisors**: Seek advice from legal or financial professionals who are knowledgeable about investment regulations in your jurisdiction. They can help you interpret regulatory requirements and assess the legitimacy of Tradeeasecapitals. It's essential to exercise caution when investing with firms that are not properly regulated or licensed, as they may pose higher risks to investors. Regulatory oversight helps ensure that investment firms comply with industry standards, safeguard investor funds, and operate in a fair and transparent manner.

Tradeeasecapitals likely implements a range of security measures to protect investors' funds and personal information. While specific measures may vary depending on the platform's policies and regulatory requirements, here are some common security practices that investment platforms like Tradeeasecapitals may employ: 1. **Encryption**: Tradeeasecapitals likely uses encryption technologies, such as Secure Sockets Layer (SSL) or Transport Layer Security (TLS), to secure communications between investors' devices and the platform's servers. This helps protect sensitive data, such as login credentials and financial information, from unauthorized access during transmission. 2. **Multi-factor Authentication (MFA)**: Tradeeasecapitals may offer multi-factor authentication as an additional layer of security for investor accounts. MFA typically requires users to provide multiple forms of verification, such as a password, a one-time code sent to their mobile device, or biometric authentication, to access their accounts. 3. **Firewalls and Intrusion Detection Systems**: Tradeeasecapitals likely employs firewalls and intrusion detection systems to monitor and control network traffic, detect unauthorized access attempts or malicious activities, and prevent cyberattacks on its systems and infrastructure. 4. **Regular Security Audits and Penetration Testing**: Tradeeasecapitals may conduct regular security audits and penetration testing to identify vulnerabilities in its systems, applications, and network infrastructure. These tests help uncover potential security weaknesses and ensure that appropriate safeguards are in place to protect investors' funds and data. 5. **Secure Data Storage**: Tradeeasecapitals likely stores investors' personal and financial information in secure, encrypted databases with access controls and permissions to restrict unauthorized access. Regular backups and data redundancy measures may also be implemented to ensure data integrity and availability. 6. **Employee Training and Awareness**: Tradeeasecapitals may provide cybersecurity training and awareness programs to its employees to educate them about best practices for protecting sensitive information, detecting phishing attempts, and responding to security incidents effectively. 7. **Regulatory Compliance**: Tradeeasecapitals likely adheres to relevant regulatory requirements and industry standards for data protection and information security, such as General Data Protection Regulation (GDPR) in the European Union or the Gramm-Leach-Bliley Act (GLBA) in the United States. 8. **Customer Support and Incident Response**: Tradeeasecapitals may have dedicated customer support teams and incident response procedures in place to assist investors with security-related inquiries, report suspicious activities, or address security incidents promptly and effectively. It's important for investors to review Tradeeasecapitals' security policies and practices, including privacy notices and terms of service, to understand how their funds and personal information are protected. Additionally, investors should take proactive steps to safeguard their own accounts, such as using strong, unique passwords, enabling multi-factor authentication, and staying vigilant against phishing scams and fraudulent activities.

The process for withdrawing funds or liquidating investments with Tradeeasecapitals may vary depending on the specific investment products or services offered by the platform. However, here is a general outline of the process: 1. **Login to Your Account**: Log in to your Tradeeasecapitals account using your username and password. If the platform offers multi-factor authentication, you may need to provide additional verification. 2. **Navigate to Withdrawal Section**: Once logged in, navigate to the withdrawal or liquidation section of the platform. This may be located in the account settings, portfolio management dashboard, or a dedicated withdrawal page. 3. **Select Investment to Liquidate**: If you have multiple investments or holdings within your portfolio, select the investment or asset you wish to liquidate or withdraw funds from. Follow any prompts or instructions provided by the platform to initiate the withdrawal process. 4. **Specify Withdrawal Amount**: Enter the amount of funds you wish to withdraw or liquidate from your investment. Some platforms may have minimum withdrawal thresholds or restrictions on the maximum withdrawal amount. 5. **Choose Withdrawal Method**: Select your preferred withdrawal method, such as bank transfer, wire transfer, electronic funds transfer (EFT), or cryptocurrency transfer. Provide any necessary banking details or cryptocurrency wallet addresses required for the withdrawal. 6. **Review and Confirm**: Review the withdrawal request details, including the withdrawal amount, withdrawal method, and destination account information, to ensure accuracy. Confirm your withdrawal request to initiate the processing. 7. **Wait for Processing**: Depending on the platform's policies and processing times, your withdrawal request may take some time to be processed and approved. Monitor your account or notifications for updates on the status of your withdrawal request. 8. **Receive Funds**: Once your withdrawal request is processed and approved by Tradeeasecapitals, the funds will be transferred to your designated bank account, cryptocurrency wallet, or other specified destination. You may receive a confirmation email or notification once the funds are successfully transferred. 9. **Monitor Account Balances**: After withdrawing funds or liquidating investments, monitor your account balances and investment holdings to ensure that the withdrawal amount reflects accurately and that your portfolio is adjusted accordingly. It's essential to familiarize yourself with Tradeeasecapitals' withdrawal policies, processing times, fees, and any terms or conditions associated with withdrawals or liquidations before initiating a withdrawal request. If you have any questions or encounter any issues during the withdrawal process, contact Tradeeasecapitals' customer support for assistance.

The quality of customer support provided by Tradeeasecapitals can significantly impact investors' experience and satisfaction with the platform. While the specific level of customer support may vary depending on the platform's policies, resources, and responsiveness, here are some common features and aspects of customer support that investors may expect from Tradeeasecapitals: 1. **Multiple Support Channels**: Tradeeasecapitals may offer multiple channels for investors to contact customer support, including email support, phone support, live chat, and online ticketing systems. Providing various support options allows investors to choose the most convenient method for their needs. 2. **Responsive and Timely Assistance**: Tradeeasecapitals strives to provide prompt and timely assistance to investors' inquiries, questions, or issues. This includes acknowledging receipt of inquiries promptly and providing timely responses or resolutions to address investors' concerns. 3. **Knowledgeable and Professional Staff**: Tradeeasecapitals' customer support team consists of knowledgeable and professional staff who are trained to assist investors with a wide range of inquiries related to account management, investment products, platform functionality, and technical support. They should possess expertise in investment products, financial markets, and regulatory requirements. 4. **Personalized Support**: Tradeeasecapitals offers personalized support tailored to investors' needs and preferences. This may include providing customized advice, guidance, or solutions based on investors' unique circumstances, investment goals, risk tolerance, and level of experience. 5. **Educational Resources and Guidance**: Tradeeasecapitals provides educational resources, tutorials, guides, and FAQs to help investors navigate the platform, understand investment products, and make informed decisions. Customer support representatives may also offer educational guidance or explanations to address investors' questions or concerns. 6. **Transparency and Communication**: Tradeeasecapitals maintains transparent communication with investors regarding platform updates, changes to policies or fees, account status, and any issues or disruptions affecting the platform's operation. Clear and open communication fosters trust and confidence among investors. 7. **Feedback and Improvement**: Tradeeasecapitals solicits feedback from investors regarding their experiences with customer support and actively seeks to improve service quality based on investor input. This may include conducting surveys, collecting testimonials, and implementing process improvements or training initiatives. Overall, Tradeeasecapitals aims to provide excellent customer support to investors, offering responsive assistance, knowledgeable guidance, personalized service, educational resources, and transparent communication to enhance investors' experience and satisfaction with the platform. Investors should feel confident in reaching out to Tradeeasecapitals' customer support team for assistance with any questions, issues, or concerns they may have while using the platform.

Contact TradeEaseCapitals

Any question? Reach out to us and we’ll get back to you shortly.

We will be very happy to assist you on this platform.

- emailAdmin@TradeEaseCapitals.com

- phone+44 0123 4567

- teleJoin on Telegram